Some fleets may already have an excellent safety record with the minimum possible insurance premiums thanks to their impeccable safety record. As a result, fleet companies are often reactive to investigating the ROI of a new crash avoidance system. This begs the question, “What is the ROI of proactively implementing a new crash avoidance system?”

The Focus on Rising Costs

The rising costs of repairs as a result of collisions and commercial truck insurance premiums can provide an ROI even for fleets with an excellent safety record.

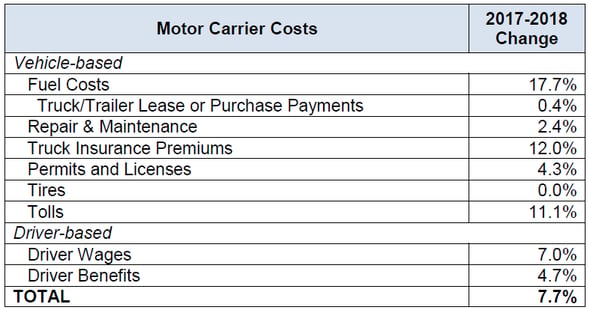

According to the American Transportation Research Institute (ATRI), between 2017 and 2018, the total average marginal costs in the trucking industry grew 7.7% overall.

Source: ATRI Report “An Analysis of the Operational Costs of Trucking: 2019 Update”

The rising cost of repairs as a result of collisions can be minimized with a crash avoidance system (not to mention lowering the risk of injury to the driver).

Commercial Trucking Insurance Premiums

The ATRI report goes on to explain that the cost of commercial trucking insurance is unpredictable. Many factors go into determining the insurance rates, not just the fleet’s safety record or crash history. Insurance carriers are always trying to balance the cost of insurance and the risk of liability. There are many reasons why insurance carriers increase premiums but are mostly caused by:

- Increasing litigation

- Increased traffic due to expanding population

- The rising price/value of vehicles

According to the ATRI Report:

“With more people on the road as a result of a growing economy, the likelihood of a crash increases. Seemingly independent of increasing traffic-related crash risk, truck-involved crashes are generating dramatic increases in both the number of civil litigation case filings as well as increases in jury awards and out-of-court settlements.”

So how do you factor this into a traditional ROI calculation?

The Value of Being Proactive

The consequences of a crash with serious injuries can be dire for a fleet. Not only will that create direct costs for legal proceedings, an increase of insurance premiums, liabilities, vehicle downtime but also indirect costs resulting from the time spent with dealing with the crash consequences and bad safety ratings that will unavoidably result in lost business.

We recently talked to a fleet that is very well run, has a good safety record, and yet a driver fell asleep, the truck crossed the median and crashed head-on into a vehicle coming in the opposite direction.

The ROI of a crash avoidance system for this fleet, unfortunately, has now become apparent.

With Today’s Technology and the Price Points, it Makes Sense

As the cost of technology continues to drop, functionality currently exists that would have been cost-prohibitive less than five years ago. For example, modern technology that is now used in crash avoidance systems include:

-

Intelligent driver feedback

-

Computer vision

-

Artificial intelligence and machine learning

These technologies can further minimize the risk of a good driver with an excellent record from making that one costly mistake, such as falling asleep at the wheel.

Conclusion

While ROI is an important criterion to prioritize tasks and projects, when it comes to safety, doing everything possible and more is simply good business practice for commercial vehicle fleets. Proactively exploring new safety technology such as crash avoidance systems to evaluate if it results in many benefits. If these justify the costs, then why shouldn’t it be the norm?

Interested in learning how your drivers can be coached in real-time? Click below to learn more about “Walter,” our virtual co-driver that provides coaching in real-time to improve your safety record and lower costs.